The Next $100M Fortunes — Learning from the 1930s to Build in the 2025 Recession Cycle.

Seizing $100M Opportunity during the decade of Geopolitical Changes. Special Entrepreneurs Edition.

📍 Introduction — A New Cycle Begins

Ray Dalio has warned us: we are entering a new era of economic cycles — one that resembles the volatile, debt-heavy, fragmented period of the 1930s more than the post-WWII boom cycles we grew used to.

According to Dalio’s long-term debt and empire cycles, key patterns emerge:

Advanced economies are in the late stages of a debt cycle — with high leverage and rising interest rates.

Internal conflicts are escalating — populism, inequality, social polarization.

External conflicts — trade wars, supply chain nationalism, global fragmentation — are reshaping the map.

The world is heading into a stagflationary environment — weak growth + persistent inflation.

Meanwhile, we face energy transition shocks, climate instability, and AI-driven disruption across every sector.

In short — we’re heading into a low-growth, high-volatility decade, with rising political instability and accelerating technological change.

Sound familiar?

It should — it echoes the environment of Europe in the 1920s-1930s — an era of debt crises, rearmament, industrial reinvention, and extreme inequality.

But history shows us something else too:

👉 In these exact moments of chaos, great fortunes are made — often by building the technologies and infrastructures that nations and citizens suddenly need.

🔍 Part 1: How Fortunes Were Built in the Pre-WWII Crisis

During the economic crisis period before World War II (roughly 1924-1939), France — like much of Europe — endured more than a decade of recession, debt crises, inflation, and political fragmentation.

And yet, some of the most powerful business empires in France and Europe were built during this time.

Here’s what worked:

Heavy Industry & Defense

Louis Renault → tanks, trucks, autos — supplier to the French army.

Marcel Dassault (Bloch) → aviation and military aircraft.

François de Wendel → steel and armaments.

Mass Market Consumer Goods

Marcel Boussac → textiles and affordable fashion for the middle classes.

Entertainment & Escapism

Charles Pathé & Léon Gaumont → cinema empires — as mass entertainment soared during dark times.

Financial Engineering

Horace Finaly at Paribas → mastering cross-border banking and corporate finance.

Key lesson:

In periods of social and economic crisis, the most successful entrepreneurs built companies that served:

✅ The state’s strategic needs → defense, infrastructure, energy, critical industries.

✅ The mass market’s survival and comfort needs → affordable housing, food, clothing, entertainment.

✅ The elite’s capital protection needs → banking, insurance, wealth preservation.

🚀 Part 2: The 2025 Opportunity — Markets Powered by New Tech

Now fast-forward to 2025.

We are again entering a crisis cycle — but with radically new technologies ready to commercialize:

1️⃣ AI & Automation

Industrial AI

Construction robots

Autonomous vehicles

AI Drones & Defense

2️⃣ Energy & Climate Tech

Small Modular Reactors (SMRs)

Advanced geothermal

Long-duration energy storage

Water tech (AWG, desalination, smart grids)

3️⃣ Food & Materials Resilience

Controlled-environment agriculture

Regenerative agriculture tech

Rare earth & battery recycling

4️⃣ Financial & Security Infrastructure

AI-driven private banking

Tokenized commodities

Climate risk insurance

Cyber defense platforms

5️⃣ Media & Virtual Economies

AI-generated cinema & games

VR/AR social platforms

Creator economy powered by generative AI

Meanwhile, Europe and the US are structurally reshaping their economies:

Defense budgets are soaring — France alone is injecting €413 billion into its defense sector over 2024-2030.

Energy independence is now a sovereign goal for Europe.

Water security and food resilience are moving up the policy agenda in drought-hit Southern Europe.

The reshoring of industry — supported by both EU and US industrial policies — will require massive investments in AI-driven automation.

Financial protection is back in demand — as families, sovereigns, and corporates seek to hedge inflation, currency instability, and systemic risks.

👉 In short — the ingredients for the next great fortunes are in place.

💰 Part 3: 10 Business Models to Build a $100M+ Fortune This Decade

Drawing from both the 1930s playbook and today’s market shifts, here are the 10 most promising business models for entrepreneurs aiming to build $100M+ companies over the next 10 years:

1️⃣ Defense & Dual-Use Technologies

→ Autonomous drones, drone defense, cyber defense, energy-resilient communications.

→ The modern parallel to Renault’s tanks and Dassault’s aircraft.

→ Huge sovereign demand.

2️⃣ Industrial AI & Automation

→ AI for manufacturing, construction, and agriculture.

→ Fills the labor shortage and reshoring gaps.

3️⃣ Energy Resilience

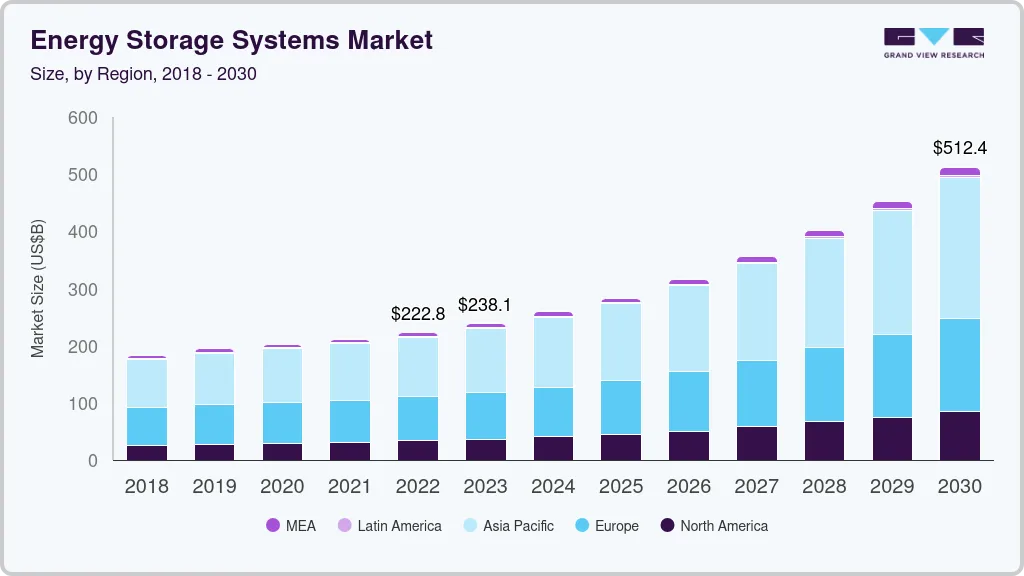

→ SMRs, geothermal, energy storage, grid optimization.

→ National energy independence is top priority.

4️⃣ Water Security Technologies

→ Atmospheric water generation (AWG), desalination, water grids, water trading.

→ Growing need across drought-stricken Europe.

5️⃣ Affordable, Resilient Housing

→ Modular off-grid housing, AI-designed climate-resilient architecture.

→ Driven by both climate migration and housing shortages.

6️⃣ Food Security Infrastructure

→ Indoor farming, regenerative ag tech, shelf-stable protein supply chains.

→ Food supply is becoming a strategic concern.

7️⃣ Critical Materials & Circular Supply Chains

→ Rare earth recycling, battery recycling, circular metals.

→ EU’s Green Deal depends on local supply chain resilience.

8️⃣ AI-Driven Financial Infrastructure

→ Private banking platforms, tokenized commodities, capital preservation tools.

→ Protecting wealth in volatile markets is a growth sector.

9️⃣ Climate Risk & Insurance Technologies

→ Parametric insurance for floods, droughts, fire risk.

→ Climate risk markets will boom.

10️⃣ AI-Generated Media & Escapism

→ AI cinema, gaming, AR/VR entertainment platforms.

→ Every crisis cycle sparks new forms of escapist entertainment.

🧭 Summary Insight: Adaptation Capitalism in Action

If you look closely, a clear pattern emerges:

Dual-use tech will capture state and private capital.

Automation will replace labor gaps and enable reshoring.

Resilience markets — in energy, water, food, housing — will be driven by existential demand.

Wealth protection markets will expand as elites seek stability.

Escapist media will flourish as societies face chronic uncertainty.

In short:

👉 The next $100M fortunes will be built not in hype cycles — but by serving the sovereign, the survival, and the system.

This is Adaptation Capitalism.

And this decade will reward those who build for it.

Why Atlas Capital Holds a Strategic Edge

Atlas Capital uniquely positions investors ahead of mainstream capital flows through an adaptation-first investment thesis, proprietary pipeline via family office co-investment networks, frontier tech companies founders attending our conferences, and other general partners of prominent funds active in the space. This offers a critical first-mover advantage and foresight on what is bankable and what’s not.

Call to Action — Capitalizing on the Immediate Opportunity

The opportunity to capture asymmetric returns in the Adaptation Capitalism is unfolding now—well before institutional capital fully saturates these markets.

📌 Next Issue → Deep Dive: Mapping The HNWI’s Capital Flows

In the next issue, I’ll break down:

Where VC and PE capital is flowing into these sectors in USA, Europe, and SEA.

Which family offices and HNWIs are positioning around this thesis.

How to build an Adaptation Capitalism portfolio — through assets diversification, both as an entrepreneur and as an investor.

Stay tuned.

— Djoann Fal

The Adaptive Economy