What defines the business winners of the next decade?

Companies are closing, businesses are struggling but amidst the chaos — but some companies are actually thriving. Why and how does your business need to adapt?

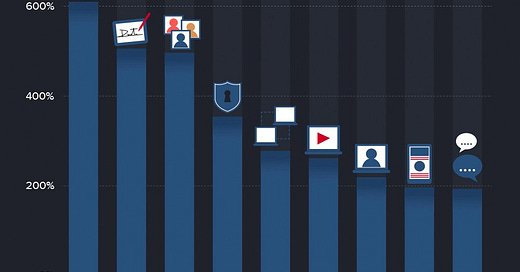

In my precedent article, we talked about how COVID-19 reshaped consumer internet habits. This week, we’ll explore how the virus has affected business software spend. The data comes from research done…

Keep reading with a 7-day free trial

Subscribe to The Adaptive Economy Newsletter by Atlas Capital to keep reading this post and get 7 days of free access to the full post archives.