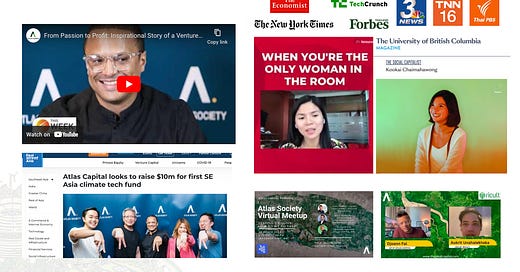

Hiring the best 👩🏻🔬 scientists to build the next Cleantech juggernauts 🐲 in South East Asia 🌏

Learn about our Climate Tech Fellow program. Join Atlas Capital. Use your career, to save the world.

Keep reading with a 7-day free trial

Subscribe to The Adaptive Economy Newsletter by Atlas Capital to keep reading this post and get 7 days of free access to the full post archives.