🚚 The Price of Tomorrow: Brace for Impacts of the Imminent Global 🏛 Carbon Tax on Greenhouse Emissions 🌬

What is the carbon tax? When is it coming to my country? What will my company have to pay? Lot of questions, Atlas Capital's team researched and answers them for you today!

Google became carbon neutral in 2007. Netflix pledged to do so in 2022. Facebook, Apple, and Amazon in 2040. Nestle and Coca-Cola in 2050. “Carbon neutrality” is the new buzzword huge companies are throwing around. While carbon neutrality has to do with sustainability, it has more to do with the economic advantages of companies. To understand this phenomenon, we first have to understand carbon pricing, then we will look at how it is implemented today, learning that there are actually different shades of this new tax, and lastly what is the timeline of implementation of these new Carbon Taxes around the world.

🚚 What is the Carbon Tax and why should I care about it?

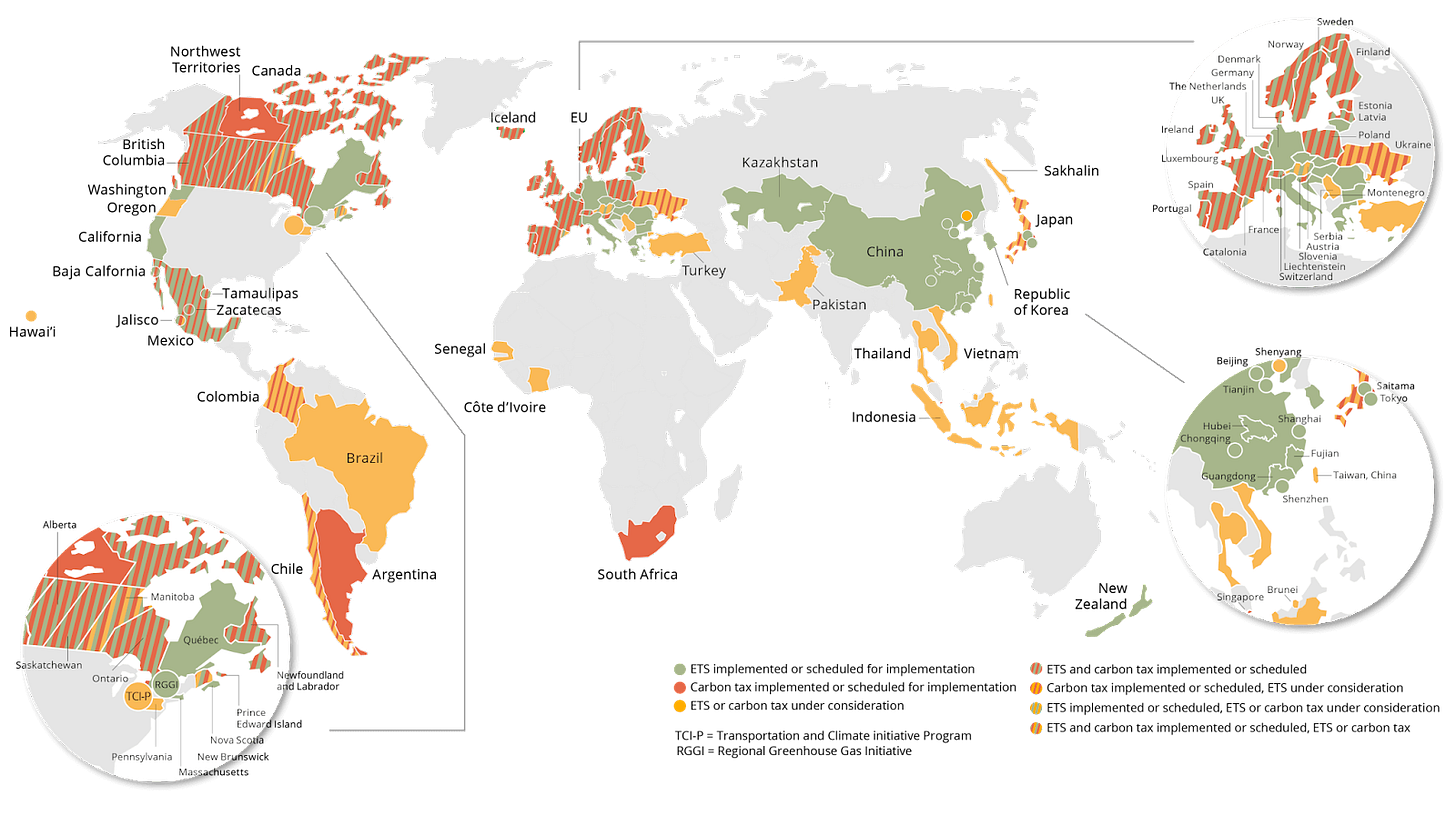

The biggest problem in economics is “externalities”. Externalities are consequences of actions that are not factored into the cost. An example is carbon emissions from a factory that harms the whole community. A carbon tax is one way to deal with the externality of carbon produced by companies. It is also a way to achieve net-zero emission in 2050. Carbon tax, which also applies to other greenhouse gases, is levied on carbon from fossil fuels consumption and industrial operations that a company is involved in. Currently, there are two schemes for carbon pricing: a carbon tax and Emissions Trading Schemes (ETS). Some countries have both carbon tax and ETS schemes in place such as Sweden while others only have one as shown in the map below. A carbon tax is a tax put on emissions one company produces. Thus, the company can produce any amount of emissions as long as it is willing to pay for the tax. The UK has a tax of 21 pounds per tonnes of emissions. ETS is a cap-and-trade scheme, which sets the limit on carbon emissions for companies. If companies exceed the limit, they can buy allowances from other companies that do not reach the limit of emissions. The price per tonnes of emissions will be determined by the market. A carbon tax for the EU is 82 Euros per tonnes (as of 20 January 2022), a 50 Euros increase from a year ago. The price is projected to be rapidly increasing due to the net-zero goal set for all companies in 2050. This is a large business opportunity for companies that achieve carbon neutrality first. When that is achieved, companies can sell carbon allocations as well as be at the head of the adoption curve.

🏛 How is the carbon tax working today?

Companies can become carbon neutral either by eliminating emissions from production or by removing as much emission from the atmosphere as they produce. For the first method, a business can opt for renewable energy as most emissions come from the use of energy from the combustion of fossil fuels. This demand for renewable energy creates a wave of new start-ups such as Solar AI and Intelcy, which aim to make renewable energy cheaper and more efficient. For the second method, there are two ways to do so: nature-based carbon capture and direct air capture. Nature-based solutions have more to do with conservation efforts, such as regenerating forests and boosting carbon uptake in rocks or in the oceans. Direct air capture requires chemical processes to capture carbon dioxide and reuse them in manufacturing or trapping them in porous rocks. Direct air capture is a more sought-after method due to the cheaper investment and long-run benefits. Certain startups, such as Noya Labs and Running Tide, are coming up with innovative ideas to make carbon capture cheaper.

For instance, Apple is launching many initiatives to become carbon neutral. First, it is encouraging its suppliers to transit from non-renewable energy sources to renewable energy sources. For example, Solvay, a large supplier for Apple, utilizes many plans to become carbon neutral. First, it invests in renewable energy in regions where renewable sources are sufficient. When this is not possible, it purchases Renewable Energy Certificates (RECs), which are certificates that a renewable energy supplier can sell to companies when it delivers electricity to the power grid. The owners of the certificates can then claim that their energy sources are green. In total, this effort will add 9 gigawatts of clean energy to Apple operations. It also launches a campaign to encourage the usage of recycled materials, such as gold and cobalt, in Apple products. This has reduced the carbon footprint in iPhone 13 Pro by 11 percent and in Macbook Pro-16 inch (2021) by 8 percent. Furthermore, it is also offsetting its carbon footprint by launching campaigns in developing nations, which will reduce carbon emissions. One such example bringing renewable energy to over 3,500 households that previously lacked access in South Africa. By doing so, Apple can claim that it has achieved carbon neutrality. Read more about Apple’s effort here.

🌬 Carbon Tax deployment around the world (2022).

Currently, across the EU region, an EU ETS scheme is used where companies are entitled to specific allowances for emissions. On top of that, countries, such as Sweden, have a carbon tax as well. Companies will incur a greater fee for not being carbon neutral. On a global scale, the EU is in the process of implementing a carbon border tax - a tax that will be placed on imports that are produced through a carbon-intensive process. It is estimated that these producers are liable for a tax of 75 Euros per tonnes of emissions in 2026. This has a far-ranging impact on the rest of the world as the EU is one of the largest importers of the world, importing a value of 1.93 trillion Euros in 2019. Thus, companies outside of the EU are also impacted by the carbon tax in the EU.

In the U.S., certain states have carbon pricing, such as California and Washington. On the federal level, there has been an ongoing discussion about a federal carbon tax, but it still requires a majority voting in the Senate. Nevertheless, support for the tax has been growing and the carbon tax de will be in place shortly.

In Asia, after 7 years of piloting in 7 cities, China has launched the largest cap-and-trade scheme and carbon-trading market in the world in February. The price per tonnes of carbon is expected to reach $10 by the end of 2022. While the tax is lower in China as compared to the EU, Chinese exporters will also be subjected to a carbon border tax as well. This can hike up the price of the imports, which prompts many Chinese companies to look towards methods to reduce emissions.

In Thailand, carbon pricing is being considered as well as experimented with before. It can be safely assumed that carbon pricing will be in place soon. According to the report by the IEA, Thailand is currently preparing its first Climate Change Act and carbon pricing will likely play a role in cutting carbon emissions. Additionally, the report suggested that the most effective range for a carbon tax is around $30 to $40 per tonne of emissions. Since 38% of emissions in Thailand originate from the power sector, the Climate Change Act will be targeted at energy producers. All companies will be affected as the power sector can pass on this increased cost to the consumers.

To avoid this, many companies look towards climate technology to reduce emissions, this is an expected multi-trillion-dollar market in which investors and entrepreneurs can grab today, and here are some of our 🎯 key findings 🎯:

The economic opportunity for carbon tech is huge, spanning numerous sectors of the economy. For 2017, the US total available market (TAM) is $1.07 trillion per year, and global TAM is $5.91 trillion per year.

To find the total available market includes, we considered all revenue from products that could be feasibly made from carbon tech materials or conversion processes.

The largest segment is fuels, which comprises 85% of the US market and 66% of the global market.

The top three global markets include fuels ($3.82 trillion), building materials ($1.37 trillion), and plastics ($0.41 trillion).

Carbontech touches both global commodities and high-value consumer goods, highlighting the diversity of products and associated business models within the carbon tech industry.

By focusing funding on vital sustainability tech innovations for our planet and cities, at Atlas Capital, we strive to support climate-tech startups that are inventing innovative solutions to curb carbon emissions.

Check out our Youtube channel where we interview entrepreneurs, corporates, and investors working on emerging sustainability tech solutions to save our planet while reinventing how we live, carbon-free.

🌊 Join the climate tech tsunami with Atlas Capital. 🌊

Sources:

https://brightly.eco/when-big-companies-are-going-carbon-neutral/

https://www.c2es.org/content/carbon-tax-basics/

https://www.worldbank.org/content/dam/Worldbank/document/Climate/background-note_ets.pdf

https://www.bcg.com/publications/2021/eu-carbon-border-tax

https://www.iea.org/reports/the-potential-role-of-carbon-pricing-in-thailands-power-sector